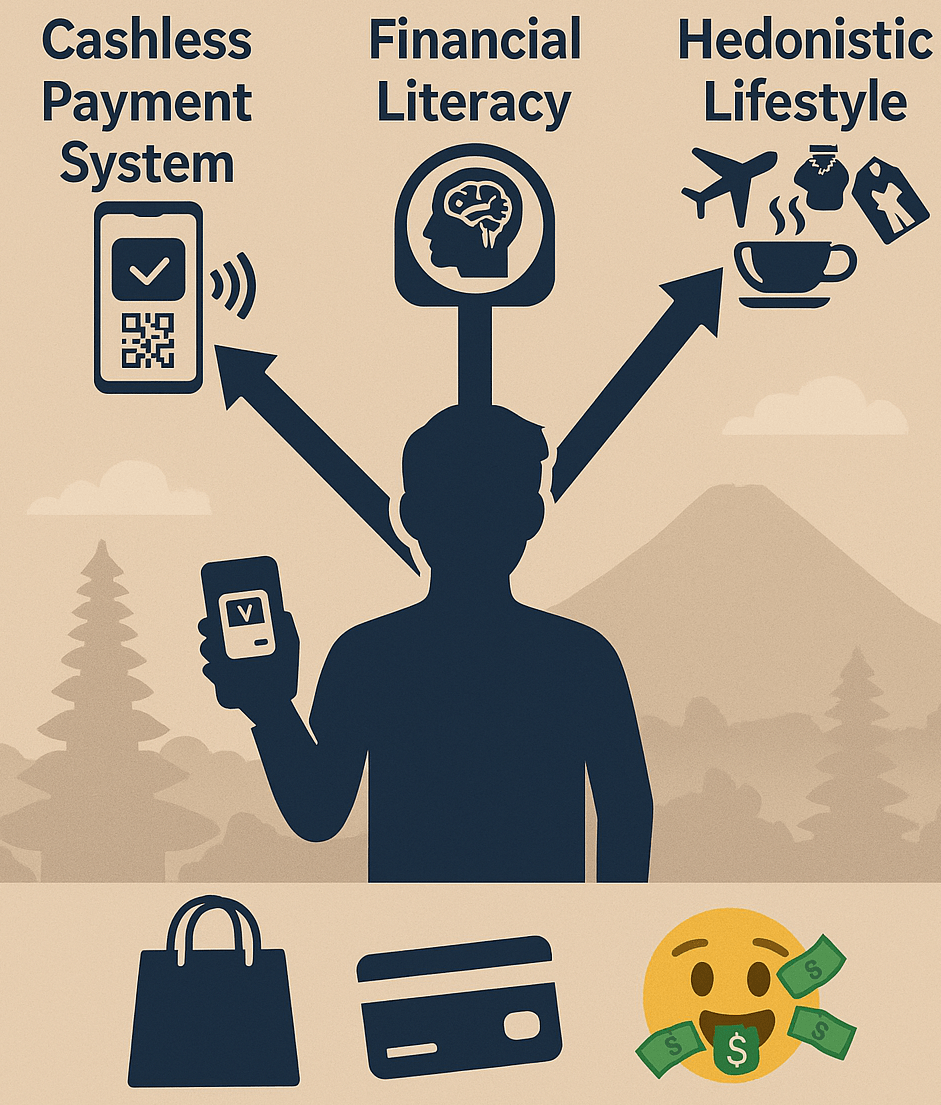

The Influence of Cashless Payment Systems, Financial Literacy, and Hedonism Lifestyle on The Consumptive Behavior of Millennial Generation in Bali Province

Published 2025-04-09 — Updated on 2025-04-10

Versions

- 2025-04-10 (2)

- 2025-04-09 (1)

Keywords

- Cashless,

- Payment system,

- Financial Literacy,

- Hedonistic Lifestyle,

- Consumptive Behavior

- Millennial Generation in Bali Province ...More

Copyright (c) 2025 Ni Wayan Tagel Miartini, Sukasmanto (Author)

This work is licensed under a Creative Commons Attribution 4.0 International License.

Abstract

The modern period of globalization and technological advancement significantly affects how millennials live their lives, where needs play a very important role in humans as economic beings. This study aims to investigate the impact of cashless payment system, financial literacy, and hedonism lifestyle on the consumptive behavior of millennial generation in Bali Province. In this study, the population studied was the millennial generation in Bali Province, which amounted to approximately 1.036.506 people. Due to the large population, the researcher used a margin of error of 10% to take the sample. Based on the Slovin formula, a sample size of 100 respondents was obtained to represent the larger population. The type of research used is quantitative research. Researchers used a questionnaire in data collection. This study uses data analysis methods in the form of multiple linear regression with t-test and F-test. The results of the analysis show that partially the three factors, namely the cashless payment system, financial literacy, and hedonism lifestyle, have a significant effect on the consumptive behavior of the millennial generation in Bali Province. The three variables simultaneously have a significant effect on the consumptive behavior of the millennial generation in Bali Province. Cashless payment systems, financial literacy, and hedonistic lifestyles have an important role in shaping

Downloads

References

- Asyik, N. F., Wahidahwati, W., & Laily, N. (2022). The Role Of Intellectual Capital In Intervening Financial Behavior and Financial Literacy on Financial Inclusion. Wseas Transactions on Business and Economics, 19, 805–814. https://doi.org/10.37394/23207.2022.19.70

- Fishbein, M, & Ajzen, I. (1975). Belief, Attitude, Intention, and Behavior: An Introduction to Theory and Research,. MA: Addison-Wesley.

- Haddouche, H., & Salomone, C. (2018). Generation Z and the tourist experience: tourist stories and use of social networks. Journal of Tourism Futures, 4(1), 69–79. https://doi.org/10.1108/JTF-12-2017-0059

- Hartawan, I. G. M. D., & Utama, I. M. S. (2018). KETAHANAN EKONOMI MASYARAKAT BALI AGAKECAMATAN BANJAR KABUPATEN BULELENG. Jurnal Buletin Studi Ekonomi, 23(2), 283–300.

- Ilahiyah, M. E., Soewarno, N., & Jaya, I. M. L. M. (2021). The Effect of Intellectual Capital and Financial Services Knowledge on Financial Inclusion. Journal of Asian Finance, Economics and Business, 8(1), 247–255. https://doi.org/10.13106/jafeb.2021.vol8.no1.247

- Jaya, I. M. L. M. (2020). Metode Penelitian Kuantitatif Dan Kualitatif: Teori, Penerapan, dan Riset Nyata (V. Wiratna Sujarweni (ed.); 1st ed.). http://www.anakhebatindonesia.com/author-i-made-laut-mertha-jaya-606.html. http://www.anakhebatindonesia.com/author-i-made-laut-mertha-jaya-606.html

- Klontz, B., Britt, S. L., Mentzer, J., & Klontz, T. (2011). Money Beliefs and Financial Behaviors: Development of the Klontz Money Script Inventory. Journal of Financial Therapy, 2(1). https://doi.org/10.4148/jft.v2i1.451

- Korteling, J. E., Paradies, G. L., & Sassen-van Meer, J. P. (2023). Cognitive bias and how to improve sustainable decision making. Frontiers in Psychology, 14(February). https://doi.org/10.3389/fpsyg.2023.1129835

- THOMAS E. BECKER, GUCLU ATINC, J. A. B., & KEVIN D. CARLSON, J. R. E. A. P. E. S. (2016). Predicting Marital Happiness and Stability from Newlywed Interactions Published by : National Council on Family Relations Predicting Marital Happiness and Stability from Newlywed Interactions. Journal of Organizational Behavior, 37(2), 157–167. https://doi.org/10.1002/job

- Tian, H., Siddik, A. B., Pertheban, T. R., & Rahman, M. N. (2023). Does fintech innovation and green transformational leadership improve green innovation and corporate environmental performance? A hybrid SEM–ANN approach. Journal of Innovation and Knowledge, 8(3). https://doi.org/10.1016/j.jik.2023.100396

- Triyonowati, Elfita, R. A., Laily, N., & Suwitho. (2022). The Nexus Between Relationship of Environmental Uncertainty and Capital Structure: Corporate Governance as Moderator. WSEAS Transactions on Business and Economics, 19, 1413–1420. https://doi.org/10.37394/23207.2022.19.127

- Wijaya, T., Darmawati, A., & Kuncoro, A. M. (2020). e-Lifestyle Confirmatory of Consumer Generation Z. International Journal of Advanced Computer Science and Applications, 11(10), 27–33. https://doi.org/10.14569/IJACSA.2020.0111004